Content

This consists of January repayments from dividends stated during the Oct, November, and December of your earlier season. See the Recommendations to have Setting 1099-DIV for special revealing requirements. If a legitimate EIN isn’t considering, the newest get back won’t become recognized. But not, if you made dumps punctually in full percentage of your own fees owed on the 12 months, you can also file the fresh get back by the March 10, 2026. Several times annually, readers of Extra Security Money (SSI) discover a couple costs in 30 days. They frequently flourish in attracting clients, nevertheless the commitment authored are momentary unless the bank delivers lingering value.

Licensed small business payroll taxation borrowing to own growing look things. To own taxation ages beginning prior to January 1, 2023, a professional small business could possibly get choose to claim as much as $250,100000 of its borrowing from the bank for growing search issues while the an excellent payroll income tax credit. The newest Inflation Reduction Act from 2022 (the new IRA) escalates the election total $five-hundred,100000 to own income tax many years beginning immediately after December 30, 2022. The brand new payroll income tax borrowing election have to be made to your or prior to the brand new due date of your own to begin with recorded tax get back (along with extensions). The fresh part of the borrowing utilized up against payroll fees is welcome in the 1st calendar one-fourth beginning following the day the accredited business recorded its income tax go back.

There are many different ways to be eligible for subscription, as well as those in active-obligations army service and their family. Someone, but not, can be register from the applying for the newest American User Council otherwise Financial Fitness Relationship. See the full list of an informed step 1-season Video game costs with other finest selections.

The new noncurrent rates for credit cards for the past three quarters were the greatest while the 4th one-fourth 2011. The newest Put Insurance coverage Finance ( https://fafafaplaypokie.com/50-lions-slot/ DIF) balance is $129 billion on the Summer 30, upwards $4 billion from the avoid of your very first one-fourth. Covered deposits diminished because of the 0.9 percent, which was slowly compared to the normal growth rate to have a next one-fourth.

A marriage of a couple anyone is known for government taxation objectives if the marriage is acknowledged by the state otherwise territory out of the usa the spot where the relationship is actually joined to your, no matter court home. 15 is now employed by the employers, along with farming businesses and you can employers in the You.S. regions. Virgin Isles, Guam, American Samoa, as well as the Commonwealth of one’s Northern Mariana Countries; and you may Bar.

American Share provides the great things about a huge financial institution, as well as easy-to-fool around with digital banking has and a good customer care. The fresh account charges few fees, and also the give is significantly more than compared to of numerous national financial institutions. But not, the fresh membership doesn’t render Automatic teller machine availableness, therefore it is smaller versatile for savers. The fresh Stephen Beck, Jr., In a position Operate away from 2014 expected the fresh Irs to ascertain a volunteer qualification program to possess elite group workplace teams (PEOs). PEOs manage various payroll management and tax revealing requirements because of their team customers and are generally repaid a fee considering payroll can cost you.

For more information on different kind of third-team payer arrangements, see area 16. Basically, while the a manager, you happen to be in charge in order that tax returns are submitted and you may deposits and you can money are built, even although you bargain having an authorized to execute these types of serves. To learn more about the different form of 3rd-team payer agreements, see section 16 out of Club. Bucks earnings which you pay to help you staff to possess farmwork are generally at the mercy of personal defense taxation and you can Medicare income tax. You can even be required to withhold, deposit, and you can statement Additional Medicare Taxation.

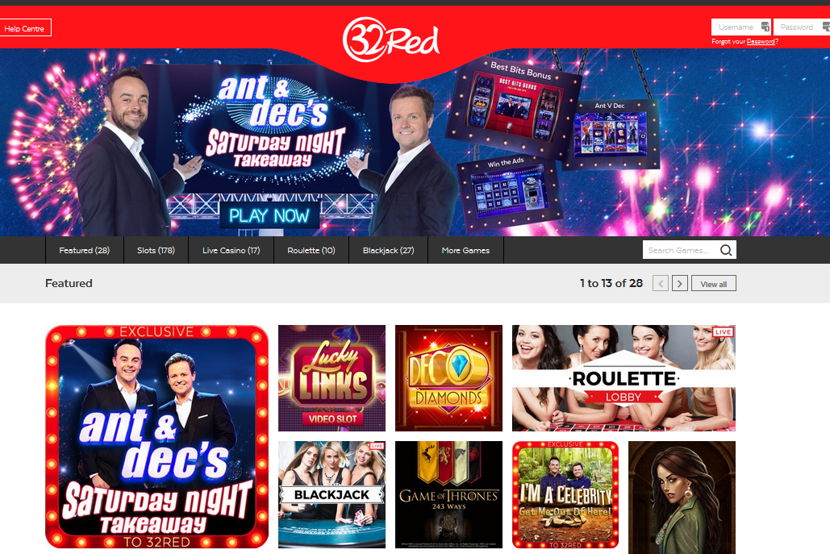

The new opinion techniques is actually rigorous and makes zero definition skipped. I look at every aspect of an advantage, from betting conditions and online game alternatives in order to financial constraints and you can withdrawal constraints. We and make up separate member reviews as well as the fresh gambling enterprise’s profile. Be confident that the brand new no-put gambling enterprises we recommend here are safe, registered and you can founded into the safer websites. When using the best gambling enterprise added bonus rules, you could typically pick from many different payment actions, in addition to borrowing from the bank and you may debit cards and you can e-wallets including PayPal, Skrill, and you may Neteller. But not, identical to contrasting the bonus amount, you will want to see the particular terminology and you can accepted actions ahead of time.

اولین نفر باشید دیدگاهی ثبت میکند

دیدگاه های کاربران